Business

Mumbai property market sees 8% surge in August; Rs1,072 crore stamp duty revenue marks 32% YoY growth: Knight Frank

-

Entertainment1 month ago

Entertainment1 month agoAmid rumours with Aishwarya Rai, Abhishek Bachchan set to embrace positivity in upcoming project – Shoojit Sircar reveals DETAILS |

-

Business1 month ago

Business1 month agoAmid deposit mobilisation challenges, Canara Bank on expansion mode: CEO

-

Entertainment4 weeks ago

Entertainment4 weeks agoKareena Kapoor Khan cheers for kids Taimur and Jeh as she takes on her ‘soccer mom duty’ in Mumbai rains – See photos |

-

Business4 weeks ago

Business4 weeks agoIndia needs 400 million more women in workforce by 2047 to fuel $14 trillion economy: Report

-

Business4 weeks ago

Business4 weeks agoCCI flags concerns over cricket rights with Reliance-Disney $8.5 billion merger

-

Business1 month ago

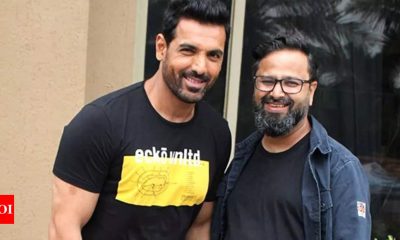

Business1 month agoHere’s why it took 20 years for John Abraham and Nikkhil Advani to become friends, DEETS INSIDE | Hindi Movie News

-

Entertainment4 weeks ago

Entertainment4 weeks agoDia Mirza marks husband Vaibhav Rekhi’s birthday with priceless memories featuring son Avyaan and daughter Samaira

-

Business7 days ago

Business7 days agoWhy around 40,000 TCS employees have received tax demand notices for Rs 50,000 to over Rs 1 lakh